Finding a new home

April has already come, and more than a month has passed since I am here. Time flies really fast. In the first trips I had tourism, and now the usual everyday life. But I’m not complaining at all, I like everything.

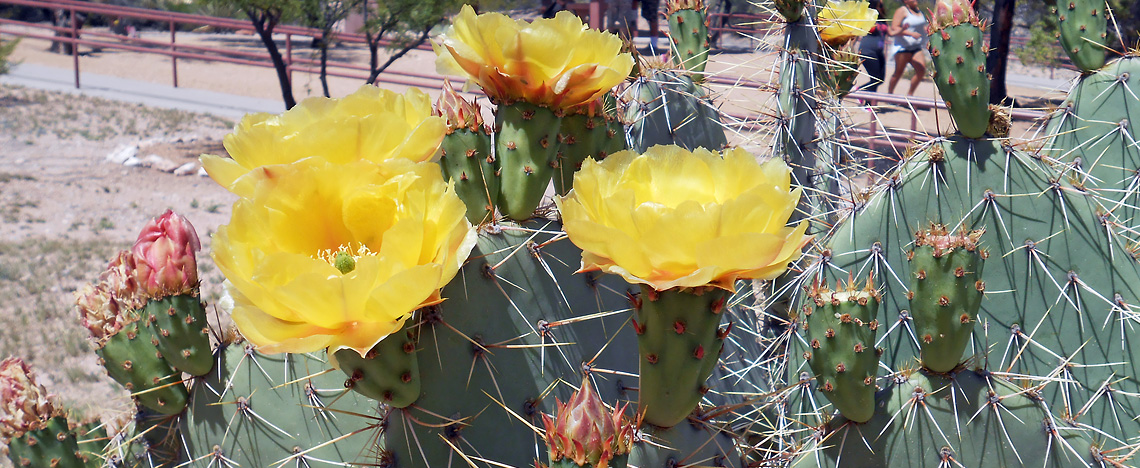

It’s been a little cold here lately. In the morning the temperature was 10 – 12 degrees, and in the afternoon 24 – 28, but now it’s hot again. On Sunday, I swam in the pool with my grandson. Everything is in bloom, the desert has turned bright yellow because shrubs in the desert are mostly yellow. Many shrubs, like all cacti, fade very quickly. As soon as I am going to photograph some bush or tree, we come next time, and they have already faded. Only mimosa and yellow acacia bloom for a long time and many people sneeze from them.

About taxes.

In the United States, all individuals must file a tax return by April 15. The declaration is submitted for the family or individually, depending on how it benefits. Even children must declare income if they have income.

You can print the form in pdf format, fill it out manually and send it by mail, or you can buy a commercial program, as my daughter did, install it on a computer, and tax number you get the base of income and deductions of your own and the whole family who made the enterprise. Then, in the form of a dialogue, you answer questions, enter additional information about your expenses and income. The program immediately calculates the tax that you are obliged to pay in addition or you are supposed to return some amount of tax. Moreover, taxes are calculated immediately both federal and regional.

This year, her daughter was working part-time and had a lot of tuition fees, so the program showed her that they should pay a little extra Arizona tax, and a good amount of federal tax should be returned to them. Then, the tax file, right in the program, was sent to the tax office (here it is called the IRS), where the information was checked, and two days later they received an email notification that their declaration was approved. A few days later the refund was credited to their account.

I didn’t run anywhere for information and didn’t take them anywhere…

I didn’t run anywhere for information and didn’t take them anywhere, however, during the year they record all the information that they might need. But such joyful events as a return do not always occur, for example, last year they had to pay extra taxes, and this year the entire return went to pay off the loan amounts for their studies. In general, taxes here are very high, maximum federal tax is up to 40%, and with local tax it can go up to 50%.

Search for a new home.

This month, the contract for renting an apartment in an apartment expires. Usually the contract is concluded for a year and is renewed annually, but this year the children decided not to renew it, but to rent a house. The fact is that the grandson’s school is moving next year to another location (here, some private schools rent a place) and Levy will not have time to take him to school and to training. Therefore, the children decided to move closer to the school and spent almost a month looking for a suitable home.

There are a lot of houses for rent, but it is very difficult to choose a neighborhood that is good, the condition of the house is good and suitable for the price, and is close to work and school. Usually, Americans don’t bother, they pick up a house, but they go to a school that is closer to home, while in our country a house is chosen closer to the school. Finally, with the help of a realtor friend, we found a suitable house, and after April 14 we will move. There is a lot of work to be done.